Standex 2018 Proxy Statement Partner Solve Deliver Food services Hydraulics Engraving Electronices Enginnering

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

STANDEX INTERNATIONAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Standex 2018 Proxy Statement Partner Solve Deliver Food services Hydraulics Engraving Electronices Enginnering

Guide to Standex’s Proxy StatementGUIDETO STANDEX’S PROXY STATEMENT

| 2 | Invitation to 2018 Annual Meeting of Shareholders | INDEX OF FREQUENTLY REQUESTED INFORMATION | ||||

| 3 | Notice of Annual Meeting of Shareholders | |||||

| 4 | Proxy Statement Summary | |||||

| 10 | Proposal One: Election of Directors | 24 | Auditor’s Fees | |||

| 16 | Proposal Two: 2018 Omnibus Incentive Plan | 26 | Board Leadership Structure | |||

| 22 | Proposal Three: Advisory Vote on Executive Compensation | 48 | CEO Pay Ratio | |||

| 23 | Proposal Four: Ratification of Independent Auditor | 49 | Clawback Provision | |||

| 25 | Governance | 39 | Compensation Consultant | |||

| 25 | 26 | Director Attendance | ||||

| 26 | 10 | Directors | ||||

| 27 | 26 | Director Independence | ||||

| 28 | 49 | Hedging Policy | ||||

| 28 | 33 | Management Stock Ownership | ||||

| 28 | 39 | Peer Group | ||||

47 | Perquisites | |||||

| 29 | 49 | Pledging Policy | ||||

| 29 | 27 | Risk Oversight | ||||

| 30 | 60 48 | Shareholder Proposals Stock Ownership Guidelines | ||||

| 30 | ||||||

| 32 | ||||||

| 33 |

INDEX OF COMMONLY USED ACRONYMS | |||||

| 35 | Compensation Discussion & Analysis | |||||

| 35 | ||||||

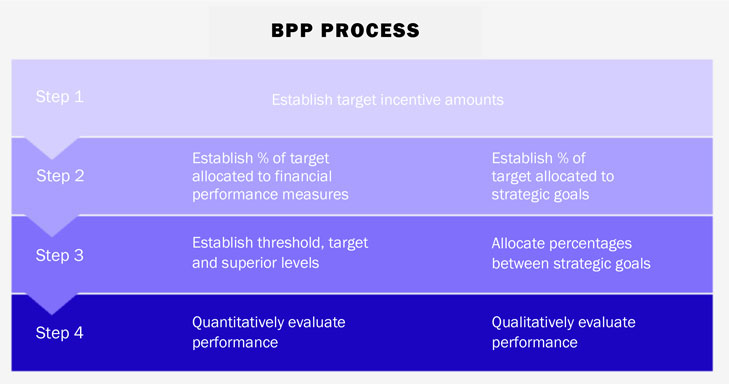

| 37 | BPP | Balanced Performance Plan | ||||

| 39 | CHRO | Chief Human Resources Officer | ||||

| 40 | CIC | Change in Control | ||||

| 48 | CLO | Chief Legal Officer | ||||

| 50 | DE | Dividend Equivalents | ||||

| 50 | EBIT | Earnings Before Income Tax | ||||

| 51 51 | EBITDA | Earnings Before Income Tax, Depreciation & Amortization | ||||

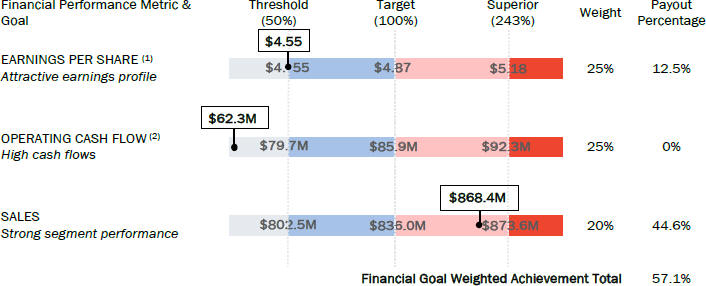

| 53 | EPS | Earnings Per Share | ||||

| 54 | GAAP | Generally Accepted Accounting Principles | ||||

| 55 | IRC | Internal Revenue Code | ||||

| 55 | IRS | Internal Revenue Service | ||||

| 55 | LTIP | Long-Term Incentive Plan | ||||

| 56 | MSPP | Management Stock Purchase Plan | ||||

| 59 | Other Information | N&CG | Nominating & Corporate Governance | |||

| 59 | NEO | Named Executive Officer | ||||

| 60 | NYSE | New York Stock Exchange | ||||

| 60 | OIP | 2018 Omnibus Incentive Plan | ||||

| 61 61 | PCAOB | Public Company Accounting Oversight Board | ||||

| 64 | Appendix A – 2018 Standex Omnibus Incentive Plan | PSUs | Performance Share Units | |||

| ROIC | Return on Invested Capital | |||||

| RSAs | Awards of Restricted Stock | |||||

| RSUs | Restricted Stock Units | |||||

| SARs | Stock Appreciation Rights | |||||

| SEC | Securities and Exchange Commission | |||||

| TSR | Total Shareholder Return | |||||

| 5 | ||||

| 6 | ||||

PROPOSALS | 12 | |||

| 12 | ||||

| 18 | ||||

| 25 | ||||

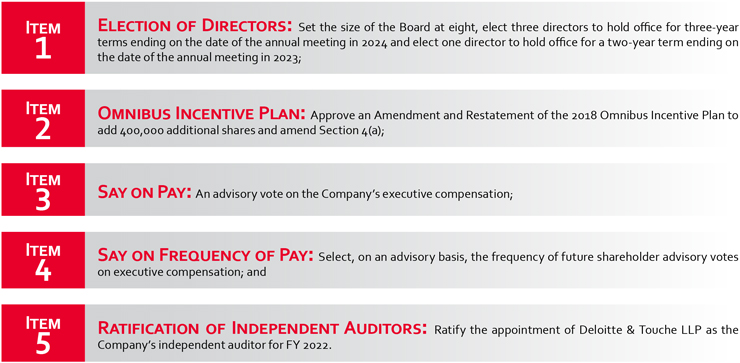

Item 4: Advisory Vote on Frequency of Advisory Vote on Executive Compensation | 26 | |||

| 27 | ||||

| 29 | ||||

| 31 | ||||

| 36 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 60 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

Compensation Committee Interlocks and Insider Participation in Compensation Decisions | 63 | |||

| 64 | ||||

| 64 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 73 | ||||

| 73 | ||||

Communications, Shareholder Proposals & Nominations and Company Documents | 74 | |||

| 75 | ||||

APPENDIX A: 2018 OMNIBUS INCENTIVE PLAN,AS AMENDEDAND RESTATED | 78 | |||

Invitation to 2018 Annual Meeting of ShareholdersINVITATIONTO 2021 ANNUAL MEETINGOF SHAREHOLDERS

Tuesday, October 23, 201826, 2021

9:00 a.m., local time

Standex International Corporation Corporate Headquarters

1123 Keewaydin Drive, Suite 300, Salem, New Hampshire 0307903079*

Dear Shareholder,

We cordially invite you to attend Standex’s Annual Meeting of Shareholders. We hope that you will join me, our Board of Directors, and other shareholders at the meeting. The attached Notice of Annual Meeting of Shareholders and Proxy Statement contain information about the business that will be conducted at the meeting. Following the meeting, I will present information on Standex’s operations and welcome any questions from shareholders.

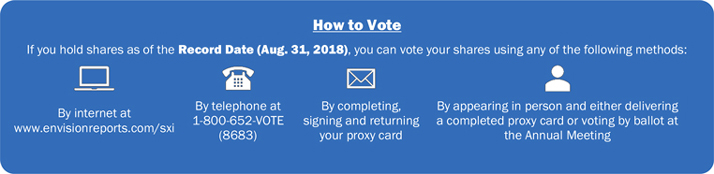

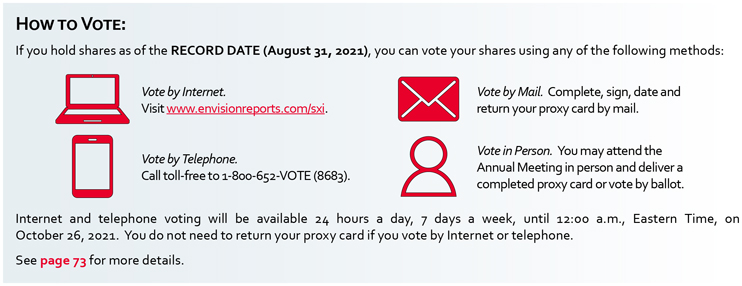

Your vote is important to us! If you plan on attending the meeting, you may vote your shares in person. If you cannot vote in person, we urge you to vote via your proxy card, over the phone or on the Internet prior to the meeting. Detailed instructions on how to vote are found on page 59.73.

Standex’s Board and senior leadership have received feedback from shareholders on the Proxy Statement. In response, we have created this new format to simplify and streamline the information that shareholders need to know. Thank you in advance for voting your shares, and thank you for your continued support of Standex.

Sincerely,

David Dunbar President/CEO Chair, Board of Directors |

Standing from left to right: Jeffrey S. Edwards, Michael A. Hickey, Robin J. Davenport (nominee for election to the Board), Charles H. Cannon, Jr., David Dunbar, and Thomas E. Chorman. Seated from left to right: B. Joanne Edwards and Thomas J. Hansen. |

| * | Our Annual Meeting will follow all |

Notice of Annual Meeting of ShareholdersNOTICEOF ANNUAL MEETINGOF

SHAREHOLDERS

The 20182021 Annual Meeting of Shareholders (the “Annual Meeting”) of Standex International Corporation (the “Company” or “Standex”) will be held on Tuesday, October 23, 201826, 2021 at 9:00 a.m., local time, at the Company’s Corporate Headquarters, located at 1123 Keewaydin Drive, Suite 300, Salem, New Hampshire 03079.*

You are receiving these proxy materials in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Standex, International Corporation, a Delaware

corporation, to be voted at the 20182021 Annual Meeting and any continuation, adjournment or postponement thereof.

Shareholders of record at the close of business on August 31, 20182021 are entitled to vote at the meeting, either in person or by proxy, on the following matters, as well as the transaction of any other business properly presented at the Annual Meeting:

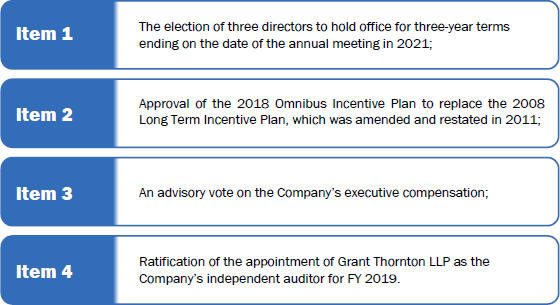

Item 4 Ratification of the appointment of Grant Thornton LLP as the Company’s independent auditor for FY 2019. Item 3 An advisory vote on the Company’s executive compensation; Item 2 Approval of the 2018 Omnibus Incentive Plan to replace the 2008 Long Term Incentive Plan, which was amended and restated in 2011; Item 1 The election of three directors to hold office for three-year terms ending on the date of the annual meeting in 2021;

On September 12, 2018,10, 2021, we began to mail our shareholders either a notice containing instructions on how to access this Proxy Statement and our Annual Report through the Internet, or a printed copy of these materials. We have provided each shareholder with a Notice of Internet Availability of Proxy Materials (the “Notice”), which encourages shareholders to review all proxy materials and our annual report and vote online atwww.envisionreports.com/sxi. We believe that reviewing materials online reduces our costs, eliminates surplus printed materials and generally reduces the environmental impact of our Annual Meeting. If you would like to receive a printed copy of our proxy materials, please follow the instructions contained in the Notice.

All proxy solicitation costs are paid by the Company. In addition to proxy solicitations made by mail, the Company’s directors and officers may solicit proxies in person or by telephone.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote your shares as soon as possible. We encourage you to vote via the Internet, since it is convenient and significantly reduces postage and processing costs. You may also vote via telephone or by mail if you received paper copies of the proxy materials. Instructions regarding the methods of voting are included in the Notice, the proxy card and this Proxy Statement on page 73.

By Order of the Proxy Statement.Board of Directors,

Alan J. Glass, Secretary

| ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON OCTOBER | As permitted by the SEC, the Reports.” | |

| * | ||

Our Annual Meeting will follow all | public health protocols, including keeping attendees at social distance and requiring all attendees to wear face coverings, which will be provided. In the unlikely event that we are not able to hold the Annual Meeting in person, we will notify all shareholders, through a press release and at |

Proxy Statement SummaryPROXY STATEMENT SUMMARY

This summary contains a general overview of this Proxy Statement. It highlights information contained elsewhere in this Proxy Statement and is meant to be used as a quick reference. This summary does NOT contain all of the information that you should consider before voting. You should read the entire Proxy Statement carefully before voting.

2018 Annual Meeting

|

|

|

You are receiving these proxy materials in connection with the solicitation of proxies by the Board of Directors of Standex International Corporation, a Delaware corporation, to be voted at the 20182021 Annual Meeting and any continuation, adjournment or postponement thereof.

On September 12, 2018,10, 2021, we began to mail our shareholders either a notice containing instructions on how to access this Proxy Statement and our Annual Report through the Internet, or a printed copy of these materials. The Notice explains how you may access and review the proxy materials and how you may submit your proxy onvia the Internet. If you would like to receive a printed copy of our proxy materials, please follow the instructions contained in the Notice.

All proxy solicitation costs are paid by the Company. In addition to proxy solicitations made by mail, the Company’s directors and officers may solicit proxies in person or by telephone.

Agenda and Voting Recommendations

| AGENDAAND VOTING RECOMMENDATIONS |

Item | Proposals | Board Vote Recommendation | ||

1 | Election of Directors | FOR | ||

2 |

| FOR | ||

3 | Advisory Vote on Executive Compensation | FOR | ||

4 | Advisory Vote on Frequency of Say on Pay | FOR “One Year” | ||

5 | Ratification of Auditors | FOR |

| 6 | 2021 PROXY STATEMENT |

| BOARD NOMINEES & CONTINUING DIRECTORS |

Age | Years of Tenure | Term Expiration | Committee Memberships | |||||||||

| Name | A | C | N&CG | |||||||||

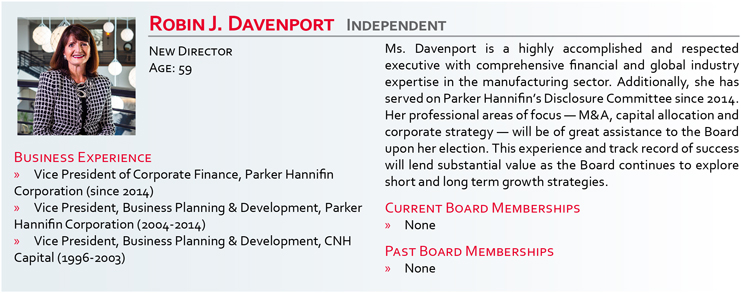

ROBIN J. DAVENPORT* INDEPENDENT Vice President of Corporate Finance, Parker Hannifin Corporation | 59 | 0 | - |  |  |  | ||||||

JEFFREY S. EDWARDS** INDEPENDENT Chairman and Chief Executive Officer, Cooper Standard Holdings, Inc. | 59 | 7 | 2021 |  |  |  | ||||||

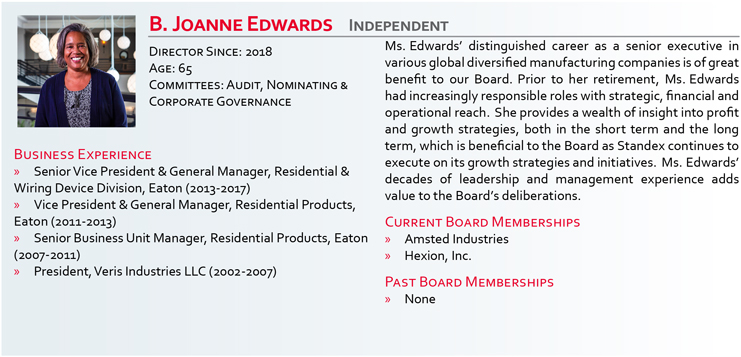

B. JOANNE EDWARDS** INDEPENDENT Former Senior Vice President and General Manager, Eaton Corporation Plc. | 65 | 3 | 2021 |  |  |  | ||||||

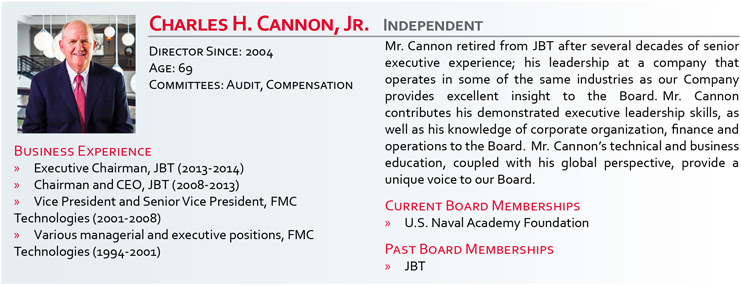

CHARLES H. CANNON, JR. INDEPENDENT Former Executive Chairman and Chief Executive Officer, John Bean Technologies | 69 | 17 | 2021 |  |  |  | ||||||

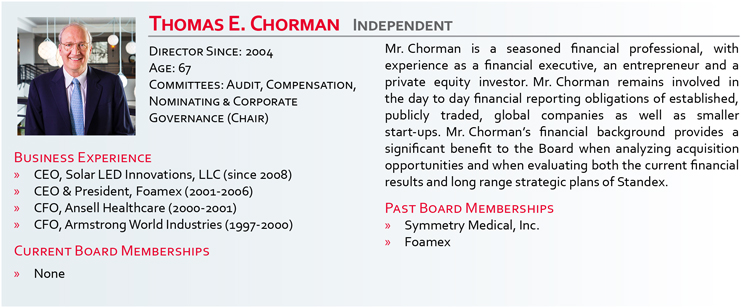

THOMAS E. CHORMAN INDEPENDENT Chief Executive Officer, Solar LED Innovations, LLC | 67 | 17 | 2022 |  |  |  | ||||||

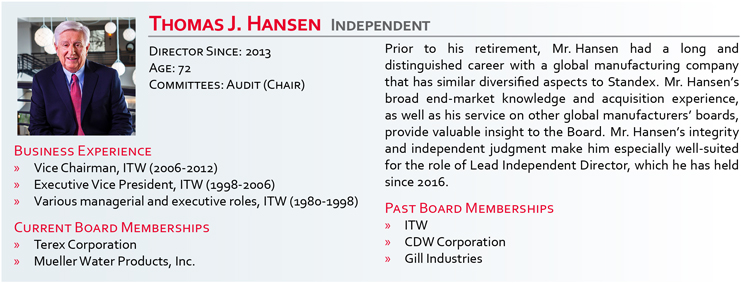

THOMAS J. HANSEN LEAD INDEPENDENT DIRECTOR Former Executive Vice Chairman, Illinois Tool Works, Inc. | 72 | 8 | 2022 |  |  |  | ||||||

DAVID DUNBAR President and Chief Executive Officer, Standex International Corporation | 59 | 7 | 2023 |  |  |  | ||||||

MICHAEL A. HICKEY INDEPENDENT Former Executive Vice President and President of Global Institutional, Ecolab, Inc. | 60 | 4 | 2023 |  |  |  | ||||||

|

C Compensation Committee | N&CG Nominating & Corporate Governance Committee |

| |||

* New nominee for Director. ** Jeffrey S. Edwards and B. Joanne Edwards are not related. | ||||||

|

|

| Class & Term Expiration | Name | Age | Director Since | Independence | Committee Memberships | |||||||||

| Audit | Comp. | N&CG** | ||||||||||||

| Class I Nominee – 2021 | Charles H. Cannon, Jr. | 66 | 2004 | Independent Director | ● | ● | ||||||||

| Class I Nominee – 2021 | Jeffrey S. Edwards* | 56 | 2014 | Independent Director | Chair | ● | ||||||||

| Class I Nominee – 2021 | B. Joanne Edwards* | 62 | new nominee | Independent Director | ||||||||||

| Class III – 2019 | Thomas E. Chorman | 64 | 2004 | Independent Director | ● | ● | Chair | |||||||

| Class III – 2019 | Thomas J. Hansen | 69 | 2013 | Lead Independent Director | Chair | |||||||||

| Class II – 2020 | David Dunbar | 57 | 2014 | Standex CEO/ Not independent | ||||||||||

| Class II – 2020 | Michael A. Hickey | 57 | 2017 | Independent Director | ● | |||||||||

| Class II – 2020 | Daniel B. Hogan | 75 | 1983 | Independent Director | ● | |||||||||

* Jeffrey S. Edwards and B. Joanne Edwards are not related.

** Nominating & Corporate Governance Committee

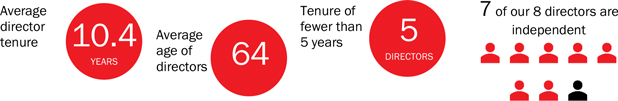

Director Snapshot

10.4 years 64 5 directors Average director tenure Average age of directors Tenure of fewer than 5 years 7 of our 8 directors are independent

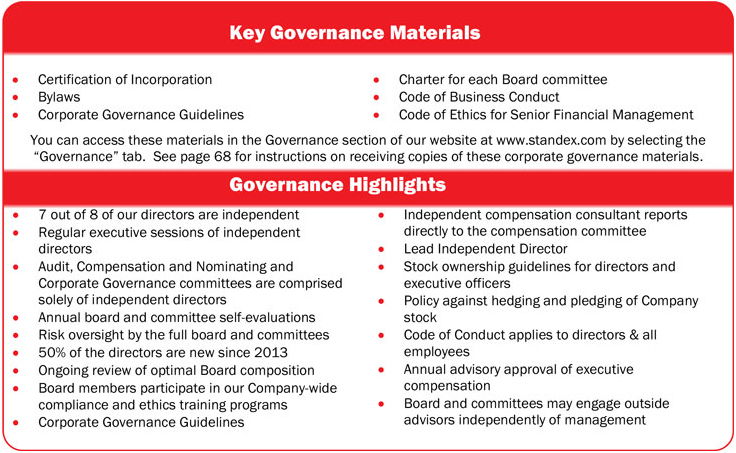

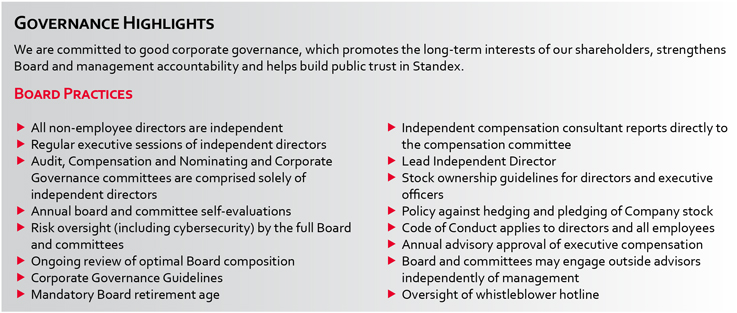

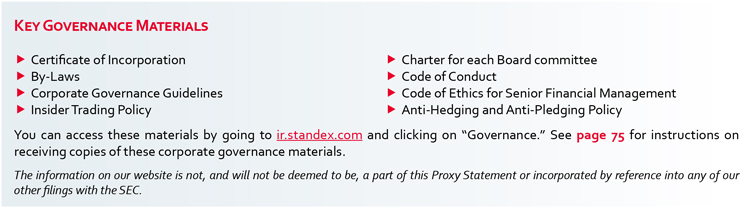

Corporate Governance Highlights

We are committed to strong corporate governance practices, which promote the long-term interests of shareholders, strengthen financial integrity and hold our Board and management accountable. The highlights of our corporate governance practices include the following:

All non-employee directors are independent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Long Term Incentive Plan (“LTIP”) is scheduled to terminate on October 28, 2018. We are asking shareholders to approve the Standex 2018 Omnibus Incentive Plan, which the Compensation Committee and the Board have adopted, subject to shareholder approval, to enable the Company to continue making equity awards to executives and other eligible participants. The following is an overview* of the key provisions of the OIP. Please see “Proposal Two: 2018 Omnibus Incentive Plan” starting on page 16 for the full summary of the OIP.

Term: 10 Years

Share Pool: 500,000

Eligibility: Any employee, Third-Party Advisor orNon-Employee Director, as selected by the Committee

Plan Administration: Compensation Committee of the Board

Key Plan Administration Powers:

|

|

|

|

|

Permitted Award Types:

|

|

|

|

|

|

|

Share Counting:

|

|

Equity Restructuring: In the event of an equity restructuring, the Administrator shall make appropriate adjustments in:

|

|

|

|

Transferability of Awards: Generally, Awards are not transferable other than by will or the laws of descent and distribution. The Compensation Committee, in its discretion, may approve the transfer of an Award by gift to certain allowable transferees.

Dividends and Dividend Equivalents (“DEs”):

|

|

|

Amendment and Termination:

|

|

|

Change in Control (“CIC”):

|

|

|

|

|

|

Director Compensation Limits: The OIP limits the aggregate annual compensation forNon-Employee Directors to $400,000, subject to certain exceptions.

* Capitalized terms have the definitions set forth in the OIP. See Appendix A, beginning on page 64 for the full text of the OIP.

|

|

|

|

|

| |||||||

|

|

| 2021 PROXY STATEMENT | 7 |

On October 23, 2018, our shareholders approved the 2018 Omnibus Incentive Plan. Under the OIP, as approved, there were 500,000 shares authorized for issuance. At the time of the approval, we believed this amount would be sufficient for award grants for the next 5 fiscal years. We have revised our estimates and we now believe there are sufficient shares available for anticipated FY 2022 grants, but there may not be sufficient shares available for FY 2023 grants. For this reason, the Board has approved and recommends an amendment to and restatement of the OIP to increase the number of shares authorized for issuance under the plan by 400,000. The Board also has approved and recommended an amendment to Section 4(a) of the OIP regarding the method of determining the number of shares available for issuance under the OIP. This amended and restated OIP would require that for every share granted under an award under the OIP, the number of total shares available for issuance be reduced by 1.0. Approval of this amendment and restatement will increase the number of currently available shares to over 600,000 and we believe this will be sufficient for anticipated grants through the next 5 fiscal years.

Please refer to page 18 for the full proposal and the plan summary. Please refer to Appendix A, starting on page 78 for the full text of the OIP, as amended and restated.

Below is some key information regarding grant practices, burn rate, dilution and overhang.

| Equity Metric | 2021 | 2020 | 2019 1 | |||||||||

Percentage of equity awards granted to NEOs | 52 | % | 51 | % | 0 | % | ||||||

Equity burn rate 2 | 1.29 | % | 0.98 | % | 0.11 | % | ||||||

Dilution 3 | 3.87 | % | 5.09 | % | 5.82 | % | ||||||

Overhang 4 | 2.81 | % | 2.11 | % | 1.88 | % | ||||||

| 1 |

|

| 2 | The burn rate is |

| 2021 | 2020 | 2019 | ||||||||||

Time-Vested Restricted Shares/Units Granted | 72,475 | 75,505 | 16,273 | |||||||||

MSPP Shares Granted | 19,311 | 14,883 | - | |||||||||

Performance-Based Stock Units Granted (at target) | 69,071 | 42,976 | - | |||||||||

Weighted Average Basic Common Stock Outstanding | 12,156,000 | 12,324,000 | 12,574,000 | |||||||||

| 3 | The dilution is calculated by taking the sum of (i) the number of shares granted and outstanding under awards at fiscal year end and (ii) the number of shares available for issuance under the OIP at fiscal year end, and dividing that sum by the number of outstanding Common Stock at fiscal year end. |

Compensation Program Design

| 4 | The overhang is calculated by taking the number of shares granted and outstanding under awards at fiscal year end and dividing it by the number of outstanding Common Stock at fiscal year end. |

| ||||||

| ||||||

| ||||||

| ||||||

|

| |||||

| ||||||

| ||||||

|

| |||||

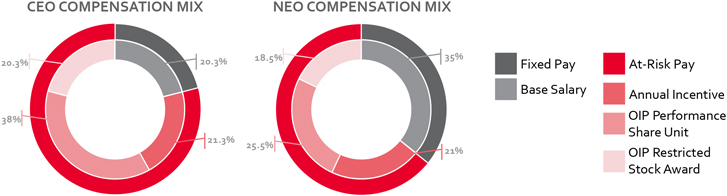

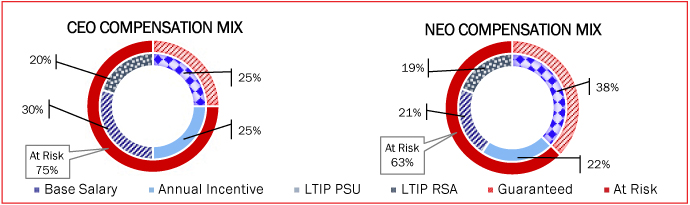

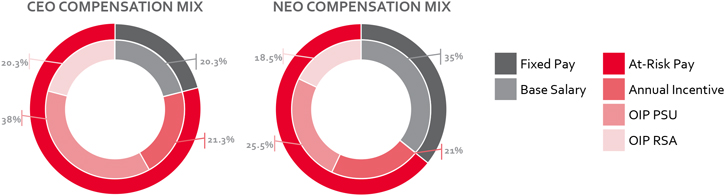

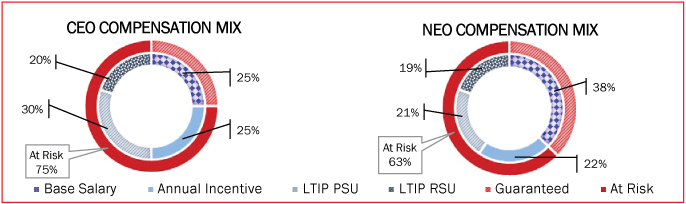

Compensation Mix

CEO COMPENSATION MIX [PERCENTAGE] [PERCENTAGE] [PERCENTAGE] [PERCENTAGE] At Risk 75% 20% 25% 30% 19% 38% 21% 22% At Risk 63% Base Salary Annual Incentive LTIP PSU LTIP RSA Guaranteed At Risk

2018 Compensation Summary

| 2021 PAYATA GLANCE |

Name & Principal Position | Salary ($) | Stock Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Value & Non-Qualified | All Other Compensation ($) | Total ($) | ||||||

David Dunbar President & CEO

| 797,327

| 2,120,875

| 357,814

| 40,012

| 112,340

| 3,428,368

| ||||||

Thomas D. DeByle Vice President, CFO & Treasurer | 408,530 | 790,571 | 120,505 | 33,668 | 58,870 | 1,412,144 | ||||||

Alan J. Glass Vice President, CLO & Secretary | 337,297 | 451,045 | 77,383 | - | 22,303 | 888,028 | ||||||

Paul C. Burns Vice President of Strategy & Business Development | 315,953 | 487,082 | 134,577 | 177 | 16,723 | 954,512 | ||||||

Ross McGovern Vice President & CHRO

| 283,800

| 246,547

| 90,267

| 6,101

| 15,939

| 642,654

| ||||||

| Named Executive Officer | Actual Salary ($) | Stock Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) 1 | |||||||||||||||

David Dunbar President & CEO | 864,870 | 3,681,435 | 772,961 | 110,204 | 5,784,732 | |||||||||||||||

Ademir Sarcevic Vice President, CFO & Treasurer | 433,675 | 894,037 | 396,649 | 26,638 | 1,751,948 | |||||||||||||||

Alan J. Glass Vice President, CLO & Secretary | 365,907 | 675,728 | 171,298 | 33,680 | 1,254,084 | |||||||||||||||

Paul C. Burns Vice President of Business Development & Strategy | 365,907 | 413,611 | 316,709 | 28,732 | 1,124,959 | |||||||||||||||

James Hooven Vice President of Operations & Supply Chain | 334,950 | 189,251 | 253,561 | 15,840 | 793,602 | |||||||||||||||

| Note: | This table provides the summary compensation information for FY |

| 1 |

Summary Compensation Table. |

|

| 9 |

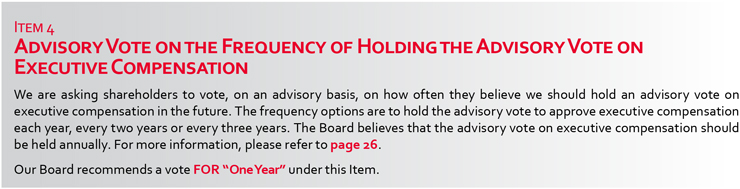

As required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, every six years, the Board provides shareholders with the opportunity to cast an advisory vote on the frequency of the advisory vote to approve our executive compensation. This year, we are seeking a non-binding determination from our shareholders as to how often the “Say on Pay” advisory vote should be held. Shareholders have the following frequency options to choose from: each year, every two years or every three years.

When this advisory vote was last held in 2015, shareholders indicated a preference to hold the advisory vote on executive compensation each year, and the Board continued this practice.

The Board continues to believe that an annual advisory Say on Pay vote is the most appropriate policy for our shareholders and the Company at this time. An annual advisory vote allows the Board to receive timely, ongoing feedback from our shareholders. This assists the Board in taking shareholder views into account when considering changes to the executive compensation program. Additionally, an annual advisory vote is currently the standard desired by many shareholders.

Although this vote is non-binding, the Board values the opinions of the Company’s shareholders and will consider the outcome of the vote when making future decisions on the frequency of our Say on Pay proposals.

| 10 | 2021 PROXY STATEMENT |

|

|

OUR BOARD RECOMMENDS YOU VOTE “FOR” THE RATIFICAION OF GRANT THORNTONThe Audit Committee has approved Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firm for the 2022 fiscal year. Deloitte has served as the Company’s independent auditors since 2021. Prior to 2021, Grant Thornton, LLP (“Grant Thornton”) served as the Company’s independent auditor. During this time, there have been no disagreements between the Company and either Deloitte or Grant Thornton on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedure. Also, during this time, neither Deloitte’s report nor Grant Thornton’s report on the Company’s financial statements contained any adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

The following are the aggregate audit andnon-audit fees billed to Standex by Deloitte, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates for FY 2021 and the aggregate audit and non-audit fees billed in FY 2020 to Standex by Grant Thornton, LLP. (“Grant Thornton”) for FYs 2017 and 2018.who served as Standex’s independent auditors during that year. A full explanation of the types of fees and Grant Thornton’sDeloitte’s role is contained in “Proposal Four: Ratification“Ratification of Independent Auditor” onAuditors” starting on page 23.27.

Type of Fees | 2017 ($) * | 2018 ($) * | 2020 ($)* | 2021 ($)* | ||||||||||||||||

Audit Fees | 1,303,000 | 1,560,000 | 1,563,000 | 1,371,000 | ||||||||||||||||

Audit-Related Fees | 336,000 | 251,000 | 239,000 | - | ||||||||||||||||

Tax Fees | 24,000 | 24,000 | 21,000 | 94,000 | ||||||||||||||||

All Other Fees | 2,000 | 2,000 | 1,000 | - | ||||||||||||||||

Total Fees | 1,665,000 | 1,837,000 | 1,824,000 | 1,465,000 | ||||||||||||||||

*

| * | Amounts have been rounded to the nearest thousand. |

What our Audit Committee considered when engaging Grant Thornton:

|

|

| |||||||

|

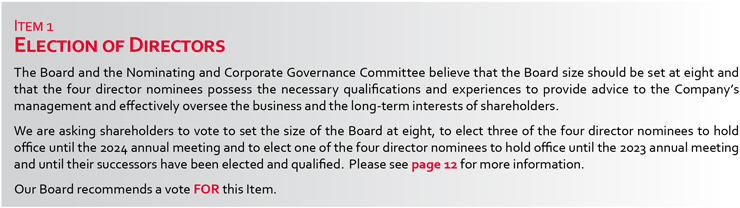

TheOur Board currently consists of seven directors; the election of Robin J. Davenport at the Annual Meeting would bring the board membership to eight. Prior to the 2020 annual meeting, the board had eight directors. At the 2020 annual meeting, Dr. Dan Hogan retired after 35 years of service. The Board had intended to recruit and nominate a successor to Dr. Hogan for election at the 2020 annual meeting. However, because of the challenges raised by the COVID-19 pandemic, the Board and Nominating & Corporate Governance Committee were unable to conduct a robust interview process in order to nominate a successor for election at the 2020 annual meeting. Over the past year, the Nominating & Corporate Governance Committee was able to engage in the recruitment process, and in April 2021, appointed Robin J. Davenport as a special advisor to the Board. She, along with the Class I directors, whose current terms are expiring, are being nominated for election to the Board.

We have three classes of directors, with each class being as equal in size as possible. The term of each class is three years. Classyears and class terms expire on a rolling basis, so that one class of directors is elected each year. The term for the 3 director nominees will expire at the 2021 annual meeting.

The Board has nominatedcurrent Class I directors are Charles H. Cannon, Jr., Jeffrey S. Edwards and B. Joanne Edwards. With the addition of Ms. Davenport, the number of Class I directors would be four, leaving only two Class II directors and two Class III directors (terms expiring at the 2023 and 2022 annual meetings, respectively). To keep the class size as equal as possible, as required by the NYSE listing standards, the Board has nominated Ms. Davenport, Mr. Edwards, and Ms. Edwards as Class I directors, with terms expiring at the 2024 annual meeting, and Mr. Cannon as a Class II director, with a term expiring at the 2023 annual meeting. This will enable each Class to be balanced and allow for orderly election cycles.

For the foregoing, the Board recommends that shareholders set the number of directors at eight, elect Ms. Davenport, Mr. Edwards, and Ms. Edwards as Class I directors for three-year terms, expiring at the three-year2024 annual meeting, and elect Mr. Cannon as a Class II director for a two-year term, expiring at the 20212023 annual meeting. Please note

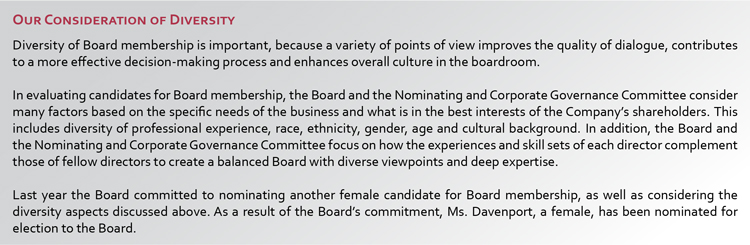

BOARDOF DIRECTORS MEMBERSHIP CRITERIA

The Board and the Nominating and Corporate Governance Committee believe that there is no relation between Jeffrey S. Edwardsare general qualifications that all directors must exhibit and B. Joanne Edwards.

In accordance with the Board’s director retirement policy, Gerald H. Fickenscher will retire fromother key qualifications and experiences that should be represented on the Board effective as a whole, but not necessarily by each individual director.

QUALIFICATIONS REQUIREDOF ALL DIRECTORS

The Board and the Nominating and Corporate Governance Committee require that each director be a recognized person of the Annual Meeting and is therefore not nominated forre-election. The Company extends its sincere thanks to Mr. Fickenscher for his 14 yearshigh integrity with a proven record of service and wishes him wellsuccess in his retirement.or her field, and be able to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple global cultures and a commitment to sustainability and to dealing responsibly with social issues. In addition, potential director candidates are interviewed to assess intangible qualities, including the individual’s ability to engage in constructive deliberations, by asking difficult questions, working collaboratively, and respecting differing views of other Board members.

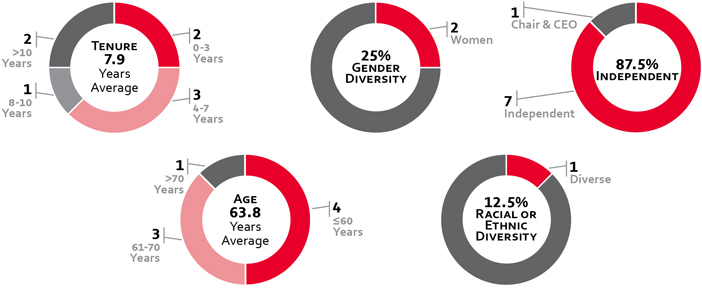

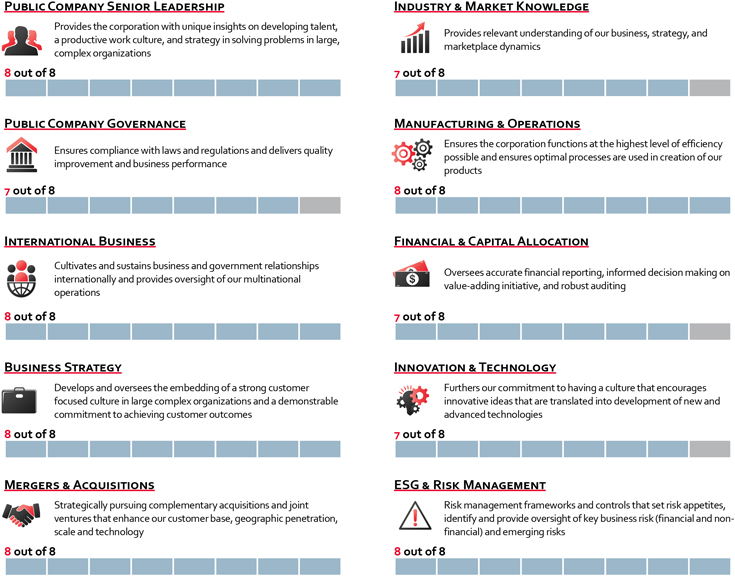

Board of DirectorsBOARD COMPOSITION & REFRESHMENT

The Board regularly reviews the skills, experience and background that it believes are desirable to be represented on the Board. On an annual basis, the Board reviews each director’s skills and assesses whether there are gaps that need to be filled. As a result, recruitment is an ongoing activity. A snapshot of our directors’ skills, including director nominees, is below, while the full skills matrix can be found under “Board Self-Assessment & Skills Matrix” of this Proxy Statement on page 34.

The Board aims to strike a balance between the experience that comes from long-term service on the Board with the new perspective that new Board members bring.bring, while being sensitive to the benefits of gender and racial diversity. The Board also has a mandatory retirement policy, wherebyunder which no director may stand forre-election if he or she has reached the age of 75. OverThe election of Ms. Davenport would bring the refreshment to 6 directors, two of which are female and one of which is a racial minority, over the past 5 years, the Company has added 4 new directors due to Board refreshment.8 years. We believe this balanced approach creates a renewed perspective that is beneficial to shareholders. Please refer to “Identifying and Evaluating Candidates for Board Membership” on page 35 for further information.

Biographical Information

| 12 | 2021 PROXY STATEMENT |

SNAPSHOTOF 2021 DIRECTOR NOMINEESAND CONTINUING DIRECTORS

DEMOGRAPHICS

SKILLS

| 2021 PROXY STATEMENT | 13 | |||||

2021 DIRECTOR NOMINEES

The following is biographical information for each director nominee and each continuing director. The information includes names, ages, principal occupations for at least the past five years, the year in which each director joined our Board and certain other information. The information is current as of September 12, 2018,10, 2021, except for theeach director’s ages,age, which areis current as ofOctober 23, 2018.

ELECTION OF DIRECTORS What are you voting on? At the 2018 Annual Meeting, 3 directors are to be elected to hold office until the 2021 annual meeting and until their successors have been elected and qualified. Two nominees are current Standex Board members who were most recently elected by shareholders at the 2015 annual meeting, and one, B. Joanne Edwards, is a new nominee whose Board service would commence upon her election at the 2018 Annual Meeting. The Board of Directors recommends that you vote “FOR” the election of each director nominee and set the number of directors at 8.

|

|

Director Nominees – ClassCLASS I DIRECTORS - TERM EXPIRING 2024:

| ||||

|

| |||

|

|

| ||||

|

| |||

|

| |||

| ||||

|

| |||

|

| |||

Class III Directors – Term Expiring 2019CLASS II DIRECTOR - TERM EXPIRING 2023:

REQUIRED VOTE & RECOMMENDATION

| ||||

|

| |||

|

| |||

|

|

| ||||

|

| |||

|

| |||

Class II Directors – Term Expiring 2020

| ||||

|

| |||

|

| |||

| ||||

|

| |||

|

| |||

| ||||

|

| |||

|

| |||

|

|

Required Vote & Recommendation

OurBy-Laws require that, in an uncontested election, each director be elected by a majority of the votes cast. A majority of votes cast means that the number of sharesvotes cast “FOR” a director’s election exceeds the number of votes cast “AGAINST” that director. Shareholders that either mark “ABSTAIN” on the proxy card or otherwise abstain from voting will not be counted as either “FOR” or “AGAINST.” Brokernon-votes will not be counted as either “FOR” or “AGAINST.”

In the event that there is a contested election, each director will be elected by a plurality of the votes cast, which means the directors receiving the largest number of “FOR” votes will be elected to the open positions.

In the event that any nominee becomes unavailable, the Board may either choose a substitute or postpone filling the vacancy until a qualified candidate is identified. If there is a substitute, the individuals acting under your proxy may vote for the election of a substitute. The nominees have indicated their willingness to serve as directors and we have no reason to believe that any nominee will become unavailable.

The Board of Directors recommends that you vote “FOR” the election of each nominee and set“FOR” setting the number of directors at 8.eight and “FOR” the election of each nominee.

| 2021 PROXY STATEMENT | 15 | |||||

CONTINUING DIRECTORS

CLASS III DIRECTORS - TERM EXPIRING 2022:

|

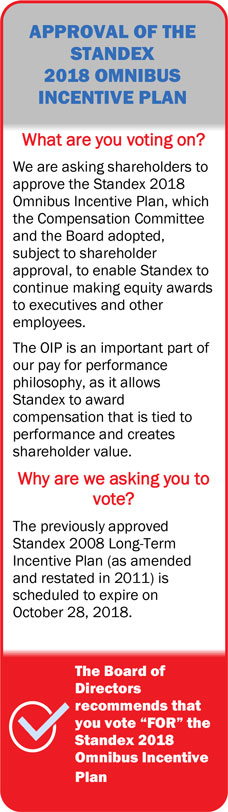

APPROVAL OF THE STANDEX 2018 OMNIBUS INCENTIVE PLAN What are you voting on? We are asking shareholders to approve the Standex 2018 Omnibus Incentive Plan, which theThe Compensation Committee recommended, and theour Board adopted,has approved, subject to shareholder approval, an amendment to enable Standex to continue making equity awards to executives and other employees. The OIP is an important partrestatement of our pay for performance philosophy, as it allows Standex to award compensation that is tied to performance and creates shareholder value. Why are we asking you to vote? The previously approved Standex 2008 Long-Term Incentive Plan (as amended and restated in 2011) is scheduled to expire on October 28, 2018. The Board of Directors recommends that you vote “FOR” the Standex 2018 Omnibus Incentive Plan

Background

As part of the Company’s continuing incentive compensation program, and upon the consideration and recommendation of the Compensation Committee, the Board approved and adopted the 2018 Omnibus Incentive Plan (“OIP”) on July 26, 2018. This amended and restated OIP would increase the number of shares authorized for grants under the OIP by 400,000 to 900,000 shares of our Common Stock. This is recommending itthe first time we have requested approval to increase the number of shares authorized for issuance under the OIP.

We are also seeking shareholder approval by the shareholders at the Annual Meeting.

In connection with the Board’s consideration and recommendationto amend Section 4(a) of the OIP regarding the Compensation Committee reviewedmethod of determining the number of shares available for issuance under the OIP. This amended and analyzedrestated OIP would require that for every share granted under an award under the OIP, the number of total shares available for issuance be reduced by 1.0. Currently, for awards that provide for a range of potential payouts, the OIP requires shares available for issuance be reduced by the maximum number of shares which may be paid under such awards. By amending Section 4(a), we believe this method of determining shares available for issuance is a more accurate reflection of our historic awards and payouts, which have generally been at or below target levels.

Our Board recommends that shareholders approve the amended and restated OIP because it will allow the Company to successfully attract and retain the best possible candidates. We previously believed that the initial 500,000 authorized shares would be sufficient to cover our anticipated needs for a period of 5 years. However, we now believe that the initial authorized shares will be sufficient for anticipated grants during FY 2022, but will likely not be sufficient for grants in FY 2023. For these reasons, the Board recommends that shareholders approve an amended and restated OIP to increase the number of Common Stock authorized for future awards to be granted under the OIP and determinedto amend Section 4(a).

As of June 30, 2021, the number of shares of Common Stock that remained available for future grants was 46,791 using the maximum dilutive impactcurrent method of determining shares available for issuance, or 208,971 using the awards permittedproposed method of determining shares available for issuance. If this proposal is approved, the combined 608,971 shares available under the OIP would be well withinrepresent approximately 5% of fully diluted Common Stock outstanding as of June 30, 2021. The Board believes that this number of shares represents a reasonable amount of potential equity dilution in light of the investor-based guidelines. Meridian Compensation Partners, LLC, the independent compensation consultant, also provided recommendations, which the Compensation Committee adopted in order to ensure thatpurposes of the OIP, complied with current standards of good governance.

as described below. If approved, the OIP will replace the Standex 2008 Long Term Incentive Plan, as amended and restated in 2011, (the “LTIP”) and the LTIP will terminate except as it relates to awards granted under the LTIP. The LTIP had a term of 10 years and is scheduled to expire on October 28, 2018.

The OIP is similarapproved and we issue awards in amounts consistent with the three-year average burn rate described below, it is anticipated that the available shares will meet our needs for approximately 5 years. Assuming shareholders approve this proposal, we will file a Registration Statement on Form S-8 to register the LTIP, which was originally approved by shareholders at the 2008 annual meeting, and approved as amended at the 2011 annual meeting. The approval of the OIP will not affect awards previously granted under the LTIP, which will remain outstanding according to their terms.additional Common Stock available for issuance.

| 18 | 2021 PROXY STATEMENT |

SIGNIFICANT HISTORICAL AWARD INFORMATION

The following summary highlightstable provides information regarding the keygrant of equity awards over the past three fiscal years. The information accounts for PSU awards at target rather than maximum.

| Equity Metric | 2021 | 2020 | 2019 1 | |||||||||

Percentage of equity awards granted to NEOs | 52% | 51% | 0% | |||||||||

Equity burn rate 2 | 1.29% | 0.98% | 0.11% | |||||||||

Dilution 3 | 3.87% | 5.09% | 5.82% | |||||||||

Overhang 4 | 2.81% | 2.11% | 1.88% | |||||||||

| 1 | FY 2019 grants made prior to the October 23, 2018 adoption of the OIP were made under the 2008 Long Term Incentive Plan. The values contained here include FY 2019 grants made under the OIP only. |

| 2 | The burn rate is calculated by taking the number of shares granted and dividing that by the weighted average basic Common Stock outstanding. The following table provides information regarding stock-settled, time-vested equity awards granted and performance-based, stock-settled equity awards granted over each of the last 3 fiscal years: |

| 2021 | 2020 | 2019 | ||||||||||

Time-Vested Restricted Shares/Units Granted | 72,475 | 75,505 | 16,273 | |||||||||

MSPP Shares Granted | 19,311 | 14,883 | - | |||||||||

Performance-Based Stock Units Granted (at target) | 69,071 | 42,976 | - | |||||||||

Weighted Average Basic Common Stock Outstanding | 12,156,000 | 12,324,000 | 12,574,000 | |||||||||

| 3 | The dilution is calculated by taking the sum of (i) the number of shares granted and outstanding under awards at fiscal year end and (ii) the number of shares available for issuance under the OIP at fiscal year end, and dividing that sum by the number of outstanding Common Stock at fiscal year end. |

| 4 | The overhang is calculated by taking the number of shares granted and outstanding under awards at fiscal year end and dividing it by the number of outstanding Common Stock at fiscal year end. |

OIP PLAN SUMMARY

The following is a brief description of the principal features of the OIP. The subsequent discussion provides more detail on its material aspects. TheThis summary and discussion areis qualified by reference to the full text of the OIP, attachedwhich is included, as amended and restated, as Appendix A to this Proxy.Proxy Statement, starting on page 78.

Highlights of the OIP

|

|

Purpose

The purpose of the OIP is the same as the purpose of the LTIP, namely, to encourage and enable executives, employees, directors and others (as defined in the OIP) to acquire a proprietary interest in Standex. This enables Standex to:

attract and maintain executive, managerial and other key employees; |

motivate participants to achieve long-range goals consistent with increases in shareholder value; |

provide incentive compensation opportunities that are flexible and competitive with those offered by other businesses; |

support the Company’s executive compensation program, as discussed in the Compensation Discussion & Analysis section of this Proxy Statement; and |

align the interests of participants with shareholder interests through compensation that is based on the value of the Company’s common stock. |

Eligibility & Types of Awards

ELIGIBILITY

The OIP authorizes the following types of awards to be made to any employee, officer,non-employee director, or Third Party Service Provider, as defined in the OIP, of the Company and its subsidiaries, as designated by the Compensation Committee. All awards will be evidenced by a written award agreement between the Company and the participant and will include such provisions and conditions as may be specified by the Compensation Committee.

| 2021 PROXY STATEMENT | 19 | |||||

Stock OptionsTYPESOF AWARDS

STOCK OPTIONS

Stock options give the holder the right to purchase shares of common stock at a specified price during specified time periods. The exercise price of an option granted under the OIP may not be less than the fair market value of the common stock on the date of grant. Stock options granted under the OIP have a maximum term of 10 years. The OIP authorizes both incentive stock options and nonqualified stock options. Incentive stock options can only be granted to employees of the Company or its subsidiaries and have an annual fair market value limit of $100,000 per recipient. TheStock options are not a part of the Company��s current compensation program.

RESTRICTED STOCKAND RESTRICTED STOCK UNITS

Awards of Restricted Stock (“RSAs”) grant the recipient shares of common stock which are subject to certain vesting requirements. Restricted Stock Unit (“RSU”) awards grant the recipient the right to receive a certain number of common stock at vesting, subject to certain vesting requirements. Recipients of such awards do not have any voting rights until the vesting requirements are satisfied, unless the Compensation Committee hasdetermines otherwise. Vesting requirements include continued employment, achievement of pre-established goals or a combination of both. The Company currently grants time-based RSAs, which do have voting rights, and also grants RSUs as part of the Management Stock Purchase Plan, which do not granted stock options since 2003, but believes that the ability to grant stock options is important to maintain flexibility in determining long-term equity compensation.have voting rights.

Stock Appreciation RightsSTOCK APPRECIATION RIGHTS

Stock Appreciation Rights (“SARs”) give the holder the right to receive, either in cash or common stock equivalent, the excess of the fair market value of one share of common stock on the date of exercise, over the exercise price of the SAR. The exercise price of the SAR may not be less than the fair market value of the common stock on the date of grant. SARs granted under the OIP have a maximum term of 10 years. SARs are not a part of the Company’s current compensation program, but the Compensation Committee believes that allowing it the ability to grant SARs maintains flexibility in determining the Company’s equity compensation.program.

Restricted Stock and Restricted Stock Units

Awards of Restricted Stock (“RSAs”) grant the recipient shares of common stock which are subject to certain

vesting requirements. Restricted Stock Unit (“RSU”) awards grant the recipient the right to receive a certain number of common stock at vesting, subject to certain vesting requirements. Recipients of such awards do not have any voting rights until the vesting requirements are satisfied, unless the Compensation Committee determines otherwise. Vesting requirements include continued employment, achievement ofpre-established goals or a combination of both. The Company currently grants time-based RSAs, which do have voting rights, and also grants RSUs as part of the Management Stock Purchase Plan, which do not have voting rights.

Unrestricted Stock AwardsUNRESTRICTED STOCK AWARDS

The Compensation Committee, in its discretion, may grant or sell to any eligible person shares of common stock free of restrictions. The sales price of such stock awards is determined by the Compensation Committee. The OIP allows the granting or selling of unrestricted stock awards as payment for past services or other valid consideration. Unrestricted stock awards cannot be sold, assigned, transferred, pledged or otherwise encumbered.

Performance AwardsPERFORMANCE AWARDS

Performance awards grant the recipient the right to receive, either in cash or shares of common stock, a payout upon the attainment ofpre-established performance goals. The Company’s current compensation program includes performance share unit awards, as a component of long-term equity incentive compensation, and performance cash awards, as annual short-term incentive compensation.

Shares

Maximum Number of Shares AvailableMAXIMUM NUMBEROF SHARES AVAILABLE

TheWith the amendment, the maximum number of shares of Company common stock which may be allocated to awards, including SARs, underis 900,000 shares.

SHARE POOLAND SHARE COUNTING

With the OIP is 500,000 shares. Any shares of Company common stock previously authorized but unissued under the LTIP will not be issued.

Fungible Pool and Share Counting

Eachamendment, each share issued pursuant to an award under the OIP will reduce the number of shares available by one share, with the exception of awards issued pursuant to a range of payouts, in which case, the share reserve will be reduced by the number of shares representing the maximum possible payout.share. Shares subject to awards under the LTIP or the OIP that terminate or expire unexercised, or are cancelled,canceled, terminated, forfeited or lapse for any reason, or are exchanged for an award that does not involve the issuance of shares and shares underlying awards that are ultimately settled in cash, will become available for future grants of awards under the OIP. Similarly, in the event that a maximum payout is not reached, the unearned shares originally subject to the award will be added back to the share reserve. The following shares do not return to the share pool and are not available for issuance under the OIP: (i) shares used to pay the exercise price or withholding taxes related to an outstanding stock option or SAR; (ii) shares that are not issued or delivered upon the exercise of an SAR; and (iii) shares repurchased by the Company on the open market with proceeds from the exercise of a stock option.

Expected Duration of the Share ReserveEXPECTED DURATIONOFTHE SHARE RESERVE

If this proposal is approved by our shareholders, we expect that the share reserve under the OIP will be sufficient for awards for approximately 5 years. Expectations regarding future share usage could be impacted by a number of factors such as award type mix; hiring and promotion activity at the executive level; the rate at which shares are returned to the OIP’s share pool upon expiration, forfeiture or cash settlement; the future performance of our stock price; the consequences of acquiring other companies; and other factors. While we believe that the assumptions are reasonable, future share usage may differ from current expectations.

Burn Rate

The following table provides information regarding stock-settled, time-vested equity awards granted and performance-based, stock-settled equity awards granted over each of the last 3 fiscal years:

| 2018 | 2017 | 2016 | ||||||||||

Time-Vested Restricted Shares/Units Granted | 51,485 | 51,563 | 48,984 | |||||||||

MSPP Shares Granted | 9,050 | 16,661 | 12,383 | |||||||||

Performance-Based Stock Units Granted (at Target) | 26,361 | 26,703 | 24,567 | |||||||||

Weighted Average Basic Common Stock Outstanding | 12,697,626 | 12,666,000 | 12,682,000 |

These burn rate figures are different from the disclosures in the Company’s Annual Reports on Form10-K for the fiscal years endings June 30, 2016, 2017 and 2018 because this table excludes all cash-settled awards. Per10-K filings, the cash-settled time-vested restricted stock units granted in 2018, 2017 and 2016 were 51,792, 51,563, and 48,984 respectively.

Overhang

The following table provides certain information regarding the Company’s existing equity compensation plans:

| 20 |

| |||||

| ||||||

|

This includes time-vested restricted stock units (120,010), stock-settled performance share units outstanding at target (58,.028) and MSPP shares granted (31,760).

Adjustments to Share ReserveADJUSTMENTSTO SHARE RESERVE

The number of shares allocated to the OIP shall be appropriately adjusted to reflect any subsequent equity restructuring, such as stock dividends, stock splits, reverse stock splits and similar matters affecting the overall number of the Company’s outstanding shares. Similarly, in the event of any other change in corporate capitalization, the Compensation Committee has the authority to make equitable adjustments to prevent dilution or enlargement of any rights granted under the OIP.

|

|

Administration

The OIP will beis administered by the Compensation Committee. The Compensation Committee will havehas the authority to:

make awards; |

designate participants; |

determine the type or types of awards to be granted to each participant and the amount, terms and conditions thereof; |

establish, adopt or revise any rules, regulations, guidelines and procedures as it may deem advisable to carry out |

prescribe forms of award agreements, and make rules, interpretations and any and all other decisions and determinations that may be required under the OIP. |

Additionally, the Compensation Committee may, by resolution, authorize any officer of the Company to designate employees as award recipients and determine the amount of such awards. This delegation is limited by: (i) not allowing the authorized officer to grant an award to an officer (defined as a reporting person under Section 16 of the Exchange Act); (ii) requiring the resolution to include the total number and/or dollar value of awards the officer is allowed to grant; and (iii) requiring the officer to periodically report to the Compensation Committee regarding the nature and scope of awards granted by the officer. Lastly, the Compensation Committee may expressly delegate to one or more of its members or to one or more officers of the Company or its affiliates or to one or more agents or advisors its administrative duties or powers under the OIP.

Treatment of Awards upon Certain Events

TREATMENTOF AWARDSUPON CERTAIN EVENTS

Termination of Continuous ServiceTERMINATIONOF CONTINUOUS SERVICE

The applicable award agreement or special plan document governing an award will specify the treatment of such award upon the termination of a participant’s continuous service. Continuous service means the absence of any interruption or termination of service as an employee, officer or director; provided that the following will not be considered an interruption in service: (i) a participant transfers employment, without interruption, between the Company and an affiliate or between affiliates, (ii) in the case of aspin-off, sale or disposition transaction where the Compensation Committee determines that no interruption will result or (iii) the participant is granted an unpaid leave of absence authorized in writing by the Company that does not exceed 12 months. The OIP defines an affiliate as any parent company of Company and each subsidiary of the Company, as those terms are defined in Section 424 of the IRC.

Change in ControlCHANGEIN CONTROL

Unless otherwise provided in an award agreement or any special plan document or separate agreement with a participant governing an award, upon the occurrence of a change in control (“CIC”) of the Company in which awards are not assumed by the surviving entity or otherwise converted into a Replacement Award, as defined in the OIP, the following shall occur:

A participant’s then-outstanding stock options and SARs that are not vested and are only subject to continuous service shall immediately become fully vested and exercisable over the exercise period set forth in the applicable award agreement. The Compensation Committee may elect to cancel such awards and pay a cash amount, unless the exercise price exceeds the value of the consideration received by the participant as a result of the CIC. |

All other awards subject to continuous service shall become fully vested. |

A participant’s then-outstanding stock options and SARs that are not vested and are subject to attaining certain performance measures shall immediately become vested and exercisable as of the date of the CIC. Where performance measures provide for a range of payouts, the number of shares that shall vest is based on the higher of (i) actual performance through the date of the CIC, or (ii) target performance. No payment shall be made if the exercise price exceeds the value of the consideration received by the participant as a result of the CIC. |

All other awards subject to attaining certain performance measures shall immediately vest and be settled based on the higher of (i) actual performance through the date of the CIC, or (ii) target performance. |

| 2021 PROXY STATEMENT | 21 | |||||

Unless otherwise provided in an award agreement or any special plan document or separate agreement with a participant governing an award, if there is a change in control of the Company and a qualifying Replacement Award is provided to the participant, the participant shall not receive any automatic vesting or acceleration of the Replaced Award, as defined in the OIP. However, if a participant’s employment is involuntarily terminated other than for cause after such a change in control, then a participant’s Replacement Award in the form of:

stock options or SARs shall become fully exercisable; |

performance-based awards shall be deemed to be fully satisfied at the target level and be paid within 60 days of the termination; and |

service-based awards shall become fully vested and paid within 60 days of the termination. |

Forfeiture EventsFORFEITURE EVENTS

Awards under the OIP will be subject to any compensation recoupment policy that the Company may adopt from time to time that is applicable to the participant, including the claw back policy. An award agreement may specify that an award will be reduced, cancelled,canceled, forfeited or recouped upon certain events, including (i) termination of employment for cause; (ii) violation of material Company policies; (iii) breach of noncompetition, confidentiality or other restrictive covenants that may apply to the participant; (iv) other conduct by the participant that is detrimental to the business or reputation of the Company; and (v) a later determination that the vesting of, or amount realized from, a performance award was based on materially inaccurate financial statements or performance metric criteria, whether or not the participant caused or contributed to such inaccuracy. The Company will also seek to recover any granted awards as required by the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act or any other law or listing standards of the NYSE.

TerminationTERMINATION & AmendmentAMENDMENT

If theThe OIP is approved at thebecame effective on October 23, 2018 Annual Meeting, it will terminate onand shall continue until October 23, 2028 unless earlier terminated by the Board or the Compensation Committee. The Board or the Compensation Committee may, at any time and from time to time, amend, modify or terminate the OIP, unless such an amendment or modification would require shareholder approval under applicable laws, regulations or the NYSE rules.

The Compensation Committee may amend, modify or terminate an outstanding award without the approval of the participant, provided however, (i) the value of such award may not be reduced or diminished without the participant’s consent; (ii) the original term of an option or SAR may not be extended without prior approval of the Company’s shareholders; (iii) subject to the anti-dilution provisions of the OIP, the exercise price of an option or base price of an SAR may not be reduced, directly or indirectly (such as an exchange of an “underwater” option or SAR for cash or for another award), without the prior approval of the Company’s shareholders; and (iv) no termination, amendment or modification of the OIP will adversely affect any award previously made under the OIP without the consent of the affected participant.

Tax Consequences of Awards

TAX CONSEQUENCESOF AWARDS

The following discussion is limited to a summary of the U.S. federal income tax provisions relating to the making, exercising and vesting of awards under the OIP and the subsequent sale of common stock acquired under the OIP. The tax consequences of awards may vary depending upon the particular circumstances, and it should be noted that the income tax laws, regulations and interpretations thereof change frequently. Participants should rely upon their own tax advisors for advice concerning the specific tax consequences applicable to them, including the applicability and effect of state, local and foreign tax laws.

Nonstatutory Stock OptionsNONSTATUTORY STOCK OPTIONS

There will be no federal income tax consequences to the optionee or to the Company upon the grant of a stock option under the OIP. When the optionee exercises a stock option, however, they will recognize ordinary income in an amount equal to the excess of the fair market value of the common stock received upon exercise over the exercise price, and the Company expects that it will be allowed a corresponding deduction. Any gain that the optionee realizes when the optionee later sells or disposes of the option shares will be short-term or long-term capital gain, depending on how long the shares were held.

SARsSTOCK APPRECIATION RIGHTS

At the time the award is granted, a participant receiving a SAR will not recognize income, and the Company will not be allowed a tax deduction. When the participant exercises the SAR, the amount of cash and the fair market value of any shares of common stock received will be ordinary income to the participant and the Company expects that it will be allowed a corresponding income tax deduction at that time.

| 22 | 2021 PROXY STATEMENT |

Restricted StockRESTRICTED STOCK

Unless a participant makes an election to accelerate recognition of income to the date of grant as described below,Generally, the participant will not recognize income and the Company will not be allowed a tax deduction, at the time a restricted stock award is granted, provided that the award is subject to restrictions on transfer and is subject to a substantial risk of forfeiture. When the restrictions lapse, the participant will recognize ordinary income equal to the fair market value of the common stock as of that date (less any amount paid for the stock), and the Company will be allowed a corresponding

|

|

income tax deduction at that time, subject to any applicable limitations under IRC Section 162(m). If the participant files an election under IRC Section 83(b) within 30 days after the date of grant of the restricted stock, they will recognize ordinary income as of the date of grant equal to the fair market value of the stock as ofon that date (less any amount paid for the stock), and the Company will be allowed a corresponding income tax deduction at that time, subject to applicable IRC Section 162(m) limitations. Any future appreciation in the stock will be taxable to the participant at capital gains rates. However, if the stock is later forfeited, the participant will not be able to recover the tax previously paid pursuant to the election. To the extent unrestricted dividends are paid during the restricted period under the applicable award agreement, any such dividends will be taxable to the participant as ordinary income and will be deductible by the Company unless the participant has made an election under IRC Section 83(b), in which case the dividends will thereafter be taxable to the participant as dividends and will not be deductible by the Company.

Stock UnitsSTOCK UNITS

A participant will not recognize income, and the Company will not be allowed a tax deduction, at the time a stock unit award is granted. Stock unit awards are typically RSUs or PSUs. Upon receipt of shares of common stock (or the equivalent value in cash) in settlement of a stock unit award, a participant will recognize ordinary income equal to the fair market value of the common stock or other property as of that date, and the Company will be allowed a corresponding income tax deduction at that time, subject to any applicable limitations under IRC Section 162(m).

Cash-Based AwardsCASH-BASED AWARDS

A participant will not recognize income at the time a cash-based award is granted (for example, when the performance goals are established). Upon receipt of cash in settlement of the award, a participant will recognize ordinary income equal to the cash received. The Company will be allowed a corresponding income tax deduction at the time the award is accrued under GAAP, as long as the award is settled within 21/ 1/2 months of the end of the fiscal year and subject to any applicable limitations under IRC Section 162(m). Otherwise, the Company will be allowed a corresponding income tax deduction at the time the award is paid.

IRC SectionSECTION 409A

If an award is subject to IRC Section 409A (which relates to nonqualified deferred compensation plans), and if the requirements of Section 409A are not met, the taxable events as described above could apply earlier than described, and could result in the imposition of additional taxes and penalties. All awards that comply with the terms of the OIP, however, are intended to be exempt from the application of IRC Section 409A or meet the requirements of Section 409A in order to avoid such early taxation and penalties.

Tax WithholdingTAX WITHHOLDING

The Company has the right to deduct or withhold, or require a participant to remit to the Company, an amount sufficient to satisfy the Company’s federal, state and local tax withholding obligations (including employment taxes) imposed by law with respect to any exercise, lapse of restriction or other taxable event arising as a result of an award under the OIP. The Compensation Committee may, at the time the award is granted or thereafter, require or permit that any such withholding requirement be satisfied, in whole or in part, by delivery of, or withholding from the award, shares having a fair market value on the date of withholding equal to the amount required to be withheld for tax purposes.

Benefits to Named Executive Officers

| 2021 PROXY STATEMENT | 23 | |||||

BENEFITSTO NAMED EXECUTIVE OFFICERS & OthersOTHERS

NoBecause awards have been granted under the OIP. If the OIP is approved, awards will be granted at the discretion of the Compensation Committee. Accordingly, future benefits under the OIP are discretionary, benefits or amounts that may be received by or allocated to eligible participants are not presently determinable. No awards that are contingent upon obtaining shareholder approval of the amendment of the OIP have been made.

Required VoteThe following table shows all of the awards under the OIP for FY 2021:

| Name and Position | Number of Shares of Common Stock Covered by Awards 1 | |||

David Dunbar, Chair, President & CEO | 50,260 | |||

Ademir Sarcevic, Vice President, CFO & Treasurer | 13,487 | |||

Alan J. Glass, Vice President, CLO & Secretary | 8,755 | |||

Paul C. Burns, Vice President of Business Development & Strategy | 7,460 | |||

James Hooven, Vice President of Operations & Supply Chain | 3,218 | |||

All current executive officers as a group | 91,844 | |||

All current non-employee directors as a group | 14,781 | |||

All employees as a group (excluding current executive officers) | 54,232 | |||

| 1 | The awards included in this column are RSAs and PSUs (at target) made under the OIP during FY 2021, and RSUs awarded pursuant to an MSPP deferral during FY 2021. |

REQUIRED VOTE & RecommendationRECOMMENDATION

Approval of this proposal will require the affirmative vote of a majority of the votes cast in person or represented by proxy. Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Brokernon-votes will not be considered to have voted on this proposal, so will have no effect on the outcome.

The Board recommends that you vote “FOR”“FOR” the adoptionamendment to and restatement of the 2018 Standex Omnibus Incentive Plan.

|

ADVISORY APPROVAL OF OUR NAMED EXECUTIVES’ COMPENSATIONWhat are you voting on?We are asking shareholders to vote on an advisory basis on the compensation paid to our named executive officers as described in this Proxy Statement.The Board of Directors recommends that you vote “FOR” the say-on-pay proposal

At each annual meeting, the Board provides shareholders with the opportunity to cast an advisory vote to approve the compensation of our named executive officers. Please see the Summary“Summary Compensation Table of this Proxy StatementTable” starting on page 5164 for full details. This proposal, commonly known as a “Say on Pay” proposal, gives our shareholders the opportunity to endorse or not endorse our executive compensation programs and policies and the total compensation paid to our named executive officers. This advisory vote does not address any specific element of compensation, but rather the overall compensation of our named executive officers and our compensation philosophy, policies and practices, as detailed in the “Compensation Discussion & Analysis” section of this Proxy Statement, beginningstarting on page 35.47.

Although this vote isnon-binding, the Board values the opinions of the Company’s shareholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

As described in more detail in the Compensation Discussion and Analysis (“CD&A”) section, we have designed our executive compensation programs to align the long-term interests of our executives with those of our shareholders, attract and retain talented individuals and reward current performance. A large portion of the compensation is tied to the Company’s performance and is paid in both performance and time-based equity that does not vest for 3 years.equity. This closely aligns both the short-term and long-term interests of our executives with those of shareholders and drives the creation of shareholder value.

We encourage shareholders to review the CD&A, which describes our philosophy and business strategy underpinning the programs, the individual elements of the compensation programs and how our compensation plans are administered.

Required VoteREQUIRED VOTE & RecommendationRECOMMENDATION

Approval of this advisory proposal will require the affirmative vote of a majority of the votes cast in person or represented by proxy. Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Brokernon-votes will not be considered to have voted on this proposal, so will have no effect on the outcome.

The advisory vote on executive compensation isnon-binding, therefore, our Board will not be obligated to take any compensation actions or adjust our executive compensation programs or policies as a result of the vote. Notwithstanding, the resolution will be considered passed with the affirmative vote of the majority of the votes cast at the Annual Meeting.

The Board recommends that you vote “FOR”“FOR” the followingnon-binding resolution:

RESOLVED, that the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of RegulationS-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.

| 2021 PROXY STATEMENT | 25 | |||||

Every six years, as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Board provides shareholders with the opportunity to cast an advisory vote on the frequency of the advisory vote to approve our executive compensation. This year, we are seeking a non-binding determination from our shareholders as to how often the “Say on Pay” advisory vote should be held. Shareholders have the following frequency options to choose from: each year, every two years or every three years.

When this advisory vote was last held in 2015, shareholders indicated a preference to hold the advisory vote on executive compensation each year and the Board continued this practice.

The Board continues to believe that an annual advisory Say on Pay vote is the most appropriate policy for our shareholders and the Company at this time. An annual advisory vote allows the Board to receive timely, ongoing feedback from our shareholders. This assists the Board in taking shareholder views into account when considering changes to the executive compensation program. Additionally, an annual advisory vote is currently the standard desired by many shareholders.

Although this vote is non-binding, the Board values the opinions of the Company’s shareholders and will consider the outcome of the vote when making future decisions on the frequency of our Say on Pay proposals.

REQUIRED VOTE & RECOMMENDATION

While the Board recommends an annual advisory vote on executive compensation, shareholders may vote to hold the advisory vote on executive compensation each year, every two years or every three years.

Abstentions will not count as votes cast on this proposal, so abstentions will have no effect on the outcome. Broker non-votes will not be considered to have voted on this proposal, so will have no effect on the outcome.

The advisory vote on the frequency of holding the advisory vote on executive compensation is non-binding, therefore, our Board will not be obligated to take any actions or change the frequency as a result of the vote.

The Board recommends that you vote “FOR” holding the advisory vote on the compensation paid to our named executive officers with a frequency of “ONE YEAR”.

| 26 |

|

|

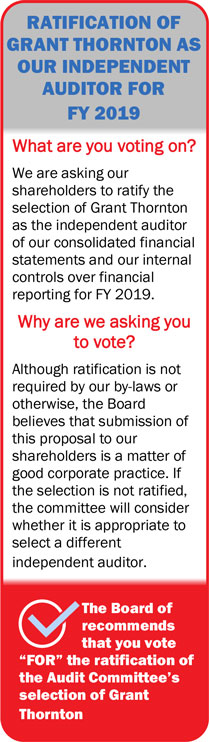

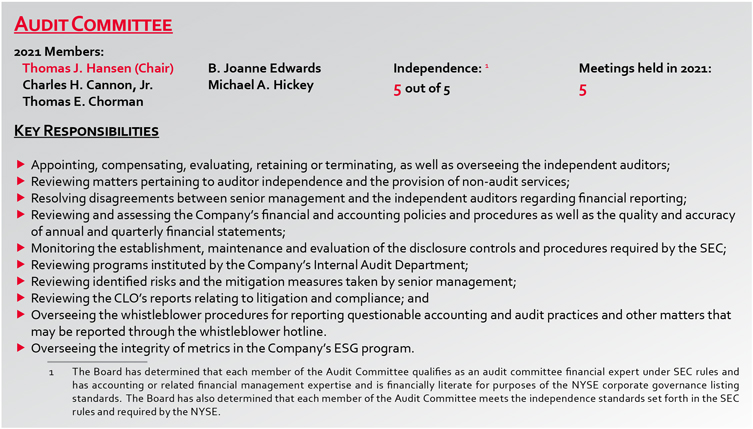

The Audit Committee has approved Grant ThorntonDeloitte & Touche LLP (“Grant Thornton”Deloitte”) to serve as our independent registered public accounting firm for the 20192022 fiscal year. Deloitte was appointed on August 26, 2020. The Company did not engage Deloitte at any time during the two years before the appointment for any accounting-related matter. In the time since Deloitte’s appointment, Deloitte’s reports on the Company’s financial statements did not contain any adverse opinion or a disclaimer of opinion, nor was Deloitte’s opinion qualified or modified as to uncertainty, audit scope or accounting principles.

Grant Thornton hasLLP (“Grant Thornton”) had served as the Company’s independent auditors since 2014.from 2014 until their replacement on August 26, 2020 as the result of a competitive process. During that time, there were no disagreements between the Company and Grant Thornton on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedure. Also, during that time, Grant Thornton’s report on the Company’s financial statements did not contain any adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

We are asking our shareholders to ratify the appointment of Grant ThorntonDeloitte as our independent registered public accounting firm. Although shareholder ratification is not required, the Board is submitting the proposal because we value our shareholders’ views on the Company’s independent auditor and as a matter of good corporate practice. In the event that our shareholders fail to ratify the appointment, the Audit Committee will investigate the reasons and consider selecting a different firm. Even if the selection is ratified, the Audit Committee may select a different independent auditor at any time during the year if it determines such a change would be in the best interests of the Company and its shareholders.

A representative from Grant ThorntonDeloitte will be available at the Annual Meeting to, as requested, to make a statement, speak with shareholders and answer anyor respond to appropriate questions.

PREPre-Approval-A PolicyPPROVAL POLICY

All services performed in FY 20182021 werepre-approved by the Audit Committee in accordance with the Audit Committee’s charter. Thepre-approval policy requires Grant Thorntonthe independent auditor to submit an itemization of the services to be provided and fees to be incurred during the fiscal year. The Audit Committee approves the scope and timing of the external audit plan and focuses on any matters that may affect the scope of the audit or the independence of Grant Thornton.the independent auditor. In that regard, the Audit Committee receives certain representations from Grant Thorntonthe independent auditor regarding its independence and the permissibility, under the applicable laws and regulations, of any services provided.

Once the initial audit plan has been approved, any requests for additional services or fees must be submitted to the Audit Committee for approval. These additional services may not commence until the Audit Committee reviews and approves the request.

These requests for approval are normally evaluated during regularly scheduled Audit Committee meetings. However, if a request is submitted between meeting times, the Chair of the Audit Committee may approve the request pursuant to a delegation of authority. ThisFor the Chair of the Audit Committee, the approval authority is limited to services valued at less than $50,000.$100,000. Any requests for services exceeding $50,000$100,000 must be approved by the full Audit Committee. If the Chair has exercised itstheir approval authority, the Chairthey must disclose all approval determinations to the full Audit Committee at the next regularly scheduled meeting.

RATIFICATION OF GRANT THORNTON AS OUR INDEPENDENT AUDITOR FOR FY 2019 What are you voting on? We are asking our shareholders to ratify the selection of Grant Thornton as the independent auditor of our consolidated financial statements and our internal controls over financial reporting for FY 2019. Why are we asking you to vote? Although ratification is not required by our by-laws or otherwise, the Board believes that submission of this proposal to our shareholders is a matter of good corporate practice. If the selection is not ratified, the committee will consider whether it is appropriate to select a different independent auditor. The Board of recommends that you vote “FOR” the ratification of the Audit Committee’s selection of Grant Thornton

Independent Auditor’s Fees

The following table summarizes the aggregate fees for Grant Thornton’s services incurred by the Company. The Audit Committeepre-approved all of these audit andnon-audit fees in accordance with thepre-approval policy described above.

| 2017 ($) * | 2018 ($)* | |||||||

Audit Fees(1) | 1,303,000 | 1,560,000 | ||||||

Audit-Related Fees(2) | 336,000 | 251,000 | ||||||

Tax Fees | 24,000 | 24,000 | ||||||

All Other Fees(3) | 2,000 | 2,000 | ||||||

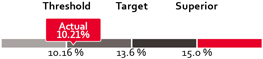

TOTAL FEES | 1,665,000 | 1,837,000 | ||||||